PROFIT FUNCTION

Given any production set Y, we have seen how to calculate the

profit function. 7г(р), which gives us the maximum profit

attainable at prices p. The profit function possesses several important

properties that follow directly from its definition. These properties are very

useful for analyzing profit-maximizing behavior.Recall that the profit function is, by definition, the maximum profits

the firm can make as a function of the vector of prices of the net outputs:7г(р) = max py у

such that у is in Y.

From the viewpoint of the mathematical results that follow, what is

important is that the objective function in this problem is a linear function

of prices.Properties of the profit function

We begin by outlining the properties of the profit function. It is

important to recognize that these properties follow solely from the assumption

of profit maximization. No assumptions about convexity, monotonicity, or other

sorts of regularity are necessary.Properties of the profit function

1)

Nondecreasing

in output prices, nonincreasing in input prices. If’ p\ > pi for all outputs

and p«- < pj for all inputs, then 7r(p») > 7r(p).2)

Homogeneous

of degree 1 in p. 7r(£p) — £тг(р) for all t > 0.3)

Convex

in p. Let

p« = fp + (1 — t)p« for 0 < t < 1. Then тг(р») < *7г(р) + (1-*)тг(р»).4)Continuous in p. The function ir(p)

is continuous, at least when 7r(p) is well-defined and pt >

0 for i = 1,…, n.Proof. We emphasize once more that the proofs of these properties follow from

the definition of the profit function alone and do not rely on any properties

of the technology.1)

Let у be a profit-maximizing net output vector at

p, so that 7r(p) = py and let y« be a profit-maximizing net output vector at p»

so that 7r(p«) = p»y«. Then by definition of profit maximization we have p»y’

> p«y. Since p»i > Pi for all i for which j/i > 0

and p\ < pi for all i for which y^ < 0, we also have

p«y > py. Putting these two inequalities together, we have » (p») = р«у» > РУ = it(p),

as required.2) Let у be a profit-maximizing net output

vector at p, so that py > py« for all y» in Y. It follows that for t

> 0, tpy > tpy« for all y» in Y. Hence у also maximizes profits at prices tp.

Thus ir(tp) = tpy = tn(p).3) Let у maximize profits at p, y’ maximize

profits at p’, and y« maximize profits at p». Then we haveтг(р»)

= p«y» = (tp + (1 — t)p«)y« = tpy» + (1 — t)p»y«. (3.1)By the definition of profit maximization, we know that

фу» < Фу = Мр)

(l-t)p«y»<(l-t)p»y« = (l-t)n(p»). Adding these two

inequalities and using (3.1). we haveTT(p»)<tTr(p) + (l-t)7T(p’).

as required.

4) The continuity of 7r(p) follows from the Theorem of the

Maximum de scribed in Chapter 27. page 506. IThe facts that the profit function is homogeneous of degree 1 and

increasing in output prices are not terribly surprising. The convexity

property, on the other hand, does not appear to be especially intuitive.

Despite this appearance there is a sound economic rationale for the convexity

result, which turns out to have very important consequences.Consider the graph of profits versus the price of a single output good,

with the factor prices held constant, as depicted in Figure 3.1. At the price

vector (p*,w*) the profit-maximizing production plan (y*,x*) yields profits p*y*

— w*x*. Suppose that p increases, but the firm continues to use the same

production plan (y*,x.*). Call the profits yielded by this passive

behavior the «passive profit function» and denote it by П(р) = py* — w*x*. This is easily seen to be a straight line. The

profits from pursuing an optimal policy must be at least as large as the

profits from pursuing the passive policy, so the graph of ir(p) must lie

above the graph of H(p). The same argument can be repeated for any price

p, so the profit function must lie above its tangent lines at every

point. It follows that n(p) must be a convex function.

PROFITS

MP)

J U(p)

= py-

— w«x»

MP’)

^j^\

S^ P*

OUTPUT PRICE

Figure The profit function. As the output price increases, the profit 3.1 function

increases at an increasing rate.The properties of the profit function have several uses. At this point we

will satisfy ourselves with the observation that these properties offer several

observable implications of profit-maximizing behavior. For example,

suppose that we have access to accounting data for some firm and observe that

when all prices are scaled up by some factor t > 0 profits do not

scale up proportionally. If there were no other apparent changes in the

environment, we might suspect that the firm in question is not maximizing profits.EXAMPLE: The effects of price stabilization

Suppose that a competitive industry faces a randomly fluctuating price

for its output. For simplicity we imagine that the price of output will be pi

with probability q and pi with probability (1 — q). It

has been suggested that it may be desirable to stabilize the price of output at

the average price P — 4P\ + (1 ~ 4)P2- How would this affect

profits of a typical firm in the industry?We have to compare average profits when p fluctuates to the

profits at the average price. Since the profit function is convex,Qir(pi) + (1 — 9)t(P2) > f(<7Pi

+ (1 — q)P2) = 7Thus average profits with a fluctuating price are at least as large as

with a stabilized price.At first this result seems counterintuitive, but when we remember the

economic reason for the convexity of the profit function it becomes clear. Each

firm will produce more output when the price is high and less when the price is

low. The profit from doing this will exceed the profits from producing a fixed

amount of output at the average price.Supply and demand functions from the profit function

If we are given the net supply function y(p), it is easy to calculate the

profit function. We just substitute into the definition of profits to findt(p) = РУ(Р)-

Suppose that instead we are given the profit function and are asked to

find the net supply functions. How can that be done? It turns out that there is

a very simple way to solve this problem: just differentiate the profit

function. The proof that this works is the content of the next proposition.Hotelling«s lemma. (The derivative property) Let j/j(p) be the firm»s net supply

function for good i. ThenVi\V = —r for г = l,…,n,

OPi

assuming that the derivative exists and that pi > 0.

Proof. Suppose (y*) is a profit-maximizing net output vector at prices (p*).

Then define the functiong(p) = тг(р) -ру*.

Clearly, the profit-maximizing production plan at prices p will always be

at least as profitable as the production plan y*. However, the plan y* will be

a profit-maximizing plan at prices p*, so the function g reaches a

minimum value of 0 at p*. The assumptions on prices imply this is an interior

minimum.The first-order conditions for a minimum then imply that

дд(р*)

Этг(р*)—£ = —и Vi = 0 for г

= 1,…, п.dpi дрг

Since this is true for all choices of p*, the proof is done. I

The above proof is just an algebraic version of the relationships

depicted in Figure 3.1. Since the graph of the «passive» profit line

lies below the graph of the profit function and coincides at one point, the two

lines must be tangent at that point. But this implies that the derivative of

the profit function at p* must equal the profit-maximizing factor supply

at that price: y(p*) = дтт(р*)/др.The argument given for the derivative property is convincing (I hope!)

but it may not be enlightening. The following argument may help to see what is

going on.Let us consider the case of a single output and a single input. In this

case the first-order condition for a maximum profit takes the simple form/Ш _ w = o. (3.2)

ax

The factor demand function x(p, w) must satisfy this first-order

condition. The profit function is given by7r(p, w) = pf(x(p, w)) — Wx(p, w).

Differentiating the profit function with respect to w, say, we

haveдтт df(x(p,w)) дх дх

-к- =

Р я я w— x(p, w)aw ox ow aw

df{x(p,w))

P я w

ox

Ox

Substituting from (3.2), we see that

дтт

— = -x(p,u,)-

The minus sign comes from the fact that we are increasing the price of an

input—so profits must decrease.This argument exhibits the economic rationale behind Hotelling’s lemma.

When the price of an output increases by a small amount there will be two

effects. First, there is a direct effect: because of the price increase the

firm will make more profits, even if it continues to produce the same level of

output.But secondly, there will be an indirect effect: the increase in the

output price will induce the firm to change its level of output by a small

amount. However, the change in profits resulting from any infinitesimal change in

output must be zero since we are already at the profit-maximizing production

plan. Hence, the impact of the indirect effect is zero, and we are left only

with the direct effect.The envelope theorem

The derivative property of the profit function is a special case of a

more general result known as the envelope theorem, described in Chapter

27, page 491. Consider an arbitrary maximization problem where the objective

function depends on some parameter a:M(a) = max f(x,a).

X

The function M(a) gives the maximized value of the objective

function as a function of the parameter a. In the case of the profit

function a would be some price, x would be some factor demand,

and M(a) would be the maximized value of profits as a function of the

price.Let x(a) be the value of x that solves the maximization

problem. Then we can also write M(a) = f(x(a), a). This simply says that

the optimized value of the function is equal to the function evaluated at the

optimizing choice.It is often of interest to know how M(a) changes as a changes.

The envelope theorem tells us the answer:dM(a) <9/(x, a)

da da=x(a)

This expression says that the derivative of M with respect to a

is given by the partial derivative of / with respect to a, holding x

fixed at the optimal choice. This is the meaning of the vertical bar to the

right of the derivative. The proof of the envelope theorem is a relatively

straightforward calculation given in Chapter 27, page 491. (You should try to

prove the result yourself before you look at the answer.)Let’s see how the envelope theorem works in the case of a simple

one-input, one-output profit maximization problem. The profit maximization

problem is7r(p, w) = max pf(x) — wx.

46 PROFIT FUNCTION (Ch. 3)

The a in the envelope theorem is p or w, and M(a)

is n(p, w). According to the envelope theorem, the derivative of

7r(p, w) with respect to p is simply the partial derivative

of the objective function, evaluated at the optimal choice:9^1 =f(X)\ = /(*(*«,)).

Op x=x(p,w)

This is simply the profit-maximizing supply of the firm at prices (p,

w).Similarly,

dn{p, w)

—я = ~x =-x(p,w),

aw x=x(p,w)

which is the profit-maximizing net supply of the factor.

Comparative statics using the profit function

At the beginning of this chapter we proved that the profit function must

satisfy certain properties. We have just seen that the net supply functions are

the derivatives of the profit function. It is of interest to see what the

properties of the profit function imply about the properties of the net supply

functions. Let us examine the properties one by one.First, the profit function is a monotonic function of the prices. Hence,

the partial derivative of 7r(p) with respect to price i will be negative

if good i is an input and positive if good i is an output. This

is simply the sign convention for net supplies that we have adopted.Second, the profit function is homogeneous of degree 1 in the prices. We

have seen that this implies that the partial derivatives of the profit function

must be homogeneous of degree 0. Scaling all prices by a positive factor t won’t

change the optimal choice of the firm, and therefore profits will scale by the

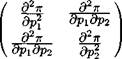

same factor t.Third, the profit function is a convex function of p. Hence, the matrix

of second derivatives of 7r with respect to p—the Hessian matrix—must be a

positive semidefinite matrix. But the matrix of second derivatives of the

profit function is just the matrix of first derivatives of the net

supply functions. In the two-good case, for example, we have

(dy,дш\

= dpidp2

I dy2dy2 I «

\ dp{op2 ‘

The matrix on the right is just the substitution matrix—how the net

supply of good г changes as the price of good j changes.

It follows from the properties of the profit function that this must be a

symmetric, positive semidefinite matrix.The fact that the net supply functions are the derivatives of the profit

function gives us a handy way to move between properties of the profit function

and properties of the net supply functions. Many propositions about

profit-maximizing behavior become much easier to derive by using this

relationship.EXAMPLE: The LeChatelier principle

Let us consider the short-run response of a firm’s supply behavior as

compared to the long-run response. It seems plausible that the firm will

respond more to a price change in the long run since, by definition, it has

more factors to adjust in the long run than in the short run. This intuitive

proposition can be proved rigorously.For simplicity, we suppose that there is only one output and that the

input prices are all fixed. Hence the profit function only depends on the

(scalar) price of output. Denote the short-run profit function by ns(p,z) where

z is some factor that is fixed in the short run. Let the long-run

profit-maximizing demand for this factor be given by z(p) so that the

long-run profit function is given by itl(p)

= ^s{Pi z{p))- Finally, let p* be some

given output price, and let z* = z(p*) be the optimal long-run demand

for the 2-factor at p*.The long-run profits are always at least as large as the short-run

profits since the set of factors that can be adjusted in the long run includes

the subset of factors that can be adjusted in the short run. It follows thath(p) = nL(p) — ns(p, 2*) = ns(p, z(p)) —

7TS(p, z*) > 0for all prices p. At the price p* the difference between

the short-run and long-run profits is zero, so that h(p) reaches a

minimum at p = p*. Hence, the first derivative must vanish at p*. By

Hotelling’s lemma, we see that the short-run and the long-run net supplies for

each good must be equal at p*.But we can say more. Since p* is in fact a minimum of h(p),

the second derivative of h(p) is nonnegative. This means thatd2nL(p*) d2ns(p*,z*) >Q

dp2 dp2

~Using Hotelling’s lemma once more, it follows that

dVLJP*) dys(p*,z*) = d2irL{p*)

d2ns(p*,z*) >Qdp dp dp2

dp2 ~This expression implies that the long-run supply response to a change in

price is at least as large as the short-run supply response at z* = z(p*).Notes

The properties of the profit function were developed by Hotelling (1932),

Hicks (1946), and Samuelson (1947).